- Investment Literacy Coach

- Posts

- Apr 15 Embracing the volatility for short term day trades

Apr 15 Embracing the volatility for short term day trades

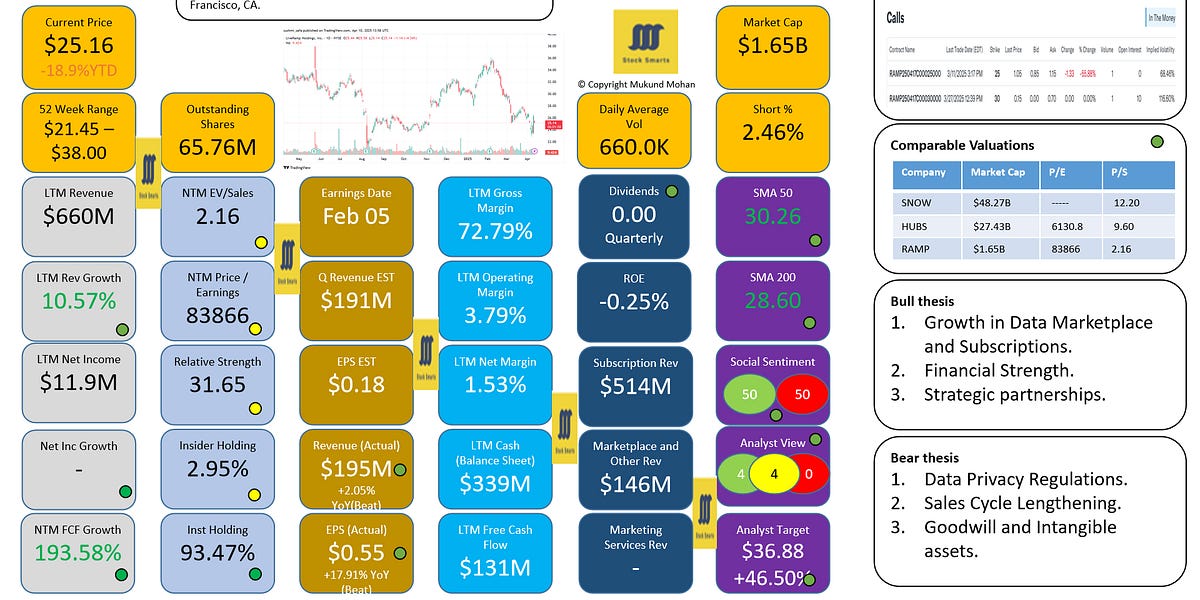

$NPWR $RAMP $

Market

“Banks earnings from $BAC ( ▼ 5.03% ) to $C ( ▼ 5.95% ) and $JPM ( ▼ 2.72% ) to $WFC ( ▼ 6.66% ) have been good, which is usually good for stocks overall, but this market has been cautious” 😊 😋

Still feels like a shot term trap to go lower

When volatility is so high with VIX trading at over 20 - 30 range, the day trades are the best with small scalps which makes the markets so much more risky. I did sell covered calls in technology and also bought QQQ puts for short term, but this is very risky as well.

Our subscription service gives specific entries and exits for both long term holds and swing positions. You should subscribe.

Insights from the portfolio

Video of the day

Today’s video is on SAP $SAP ( ▼ 0.97% ) the software and ERP company.